Hospitality Brand Leverage in a Covid World

As the world begins to realise that the impact of Covid-19 will be felt for many years to come, Design Insider takes a look at how hotel brands are responding and the lasting changes for the hospitality industry. We review the latest statistics on hotel occupancy, signs of recovery and discuss changes in consumer behaviour.

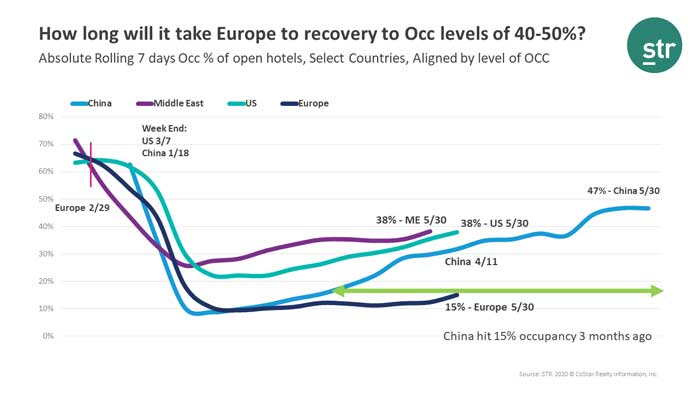

Global hospitality analysis company STR reported occupancy levels of 15% in Europe in their 4th June 2020 briefing. This figure represented open hotels which submitted data, the true occupancy within all hotels was estimated closer to 5%. Happily, there are signs of recovery, the weekend of 29-31 May showed the first occupancy green shoots in Germany, Austria, Switzerland and The Netherlands. Switzerland posted a 29% occupancy level, Germany and The Netherlands reached 23% occupancy. It is also encouraging that it took 3 months for hotels in China reach an occupancy level of 47% from 15%, the level reported in Europe. However, government guidelines could curb the potential demand, for example some German states are restricting hotels to max 60% occupancy.

The industry consensus is that drive to destinations will recover quicker than international travel for both business and leisure. We have seen this in China and the USA, where occupancy reflects domestic travellers. With UK Government hoping to lift restrictions on 4 July, there is a degree of optimism that there will be demand in the hospitality sector this summer.

A recent poll of 2,000 UK adults conducted by Caterer.com shows just under half have gained a renewed appreciation for the hospitality sector following the pandemic. The survey revealed a desire to get back into hotels, restaurants, bars and pubs. Reporting that collectively UK consumers are planning to spend £3.8bn in the first week after the Covid19 lockdown lifts.

Tripadvisor®, the world’s largest travel platform, released the findings of a study that analysed how consumer feel towards travel. They found there was more confidence around shorter trips to destinations closer to home, with nearly half (44%) of consumers saying they are more likely to take a road trip, and two thirds (61%) saying they are most comfortable taking a road trip for 3-5 days.

The research paper, entitled “Beyond COVID-19: The Road to Recovery for the Travel Industry” explores the stages to recovery, highlighting that safety, flexibility and transparency are key to rebuilding traveller confidence. Whilst all hotel groups are investing in new cleaning protocols, they are taking different approaches to instil consumer confidence. Some are collaborating with trusted consumer brands, others with trusted industry bodies and new technologies.

Hilton will begin a worldwide roll-out of a new program to deliver an industry-defining standard of cleanliness and disinfection to Hilton properties on 15th June. Hilton CleanStay, will promote their collaboration with Reckitt Benckiser (RB) makers of trusted consumer brands such as Dettol in the UK, Lysol in the USA, Sagrotan in Germany and Napisan in Italy. The trusted RB family of brands will be used in multiple markets around the world.

“As the hospitality industry evolves to address travellers’ changing expectations – especially in the wake of the coronavirus pandemic – Hilton CleanStay is the latest evolution of our commitment to providing the peace of mind and confidence our guests need to travel freely, while protecting our Team Members,” said Chris Nassetta, President and CEO of Hilton.

In contrast, Accor has developed their ALLSAFE global cleanliness with Bureau Veritas (BV), a world leader in testing, inspections, and certification. All the Group’s hotels must apply these standards and will be audited to receive this label. BV are a well-known awarding body within the cruise sector but are less known by consumers. Marriott has created the Marriott Global Cleanliness Council, rolling out enhanced technologies over the next few months, including electrostatic sprayers with hospital-grade disinfectant recommended by the Center for Disease Control and Prevention and World Health Organization.

Trust in brands will be key to instilling consumer confidence. Forbes recently published an article which predicated that the world’s 50 most valuable hotel brands could see their “brand value” fall by 20% to a combined $70 billion this year due to the near-collapse of travel driven by the Covid-19 pandemic, with expectations for a long and difficult recovery. Ultimately, we humans do need social interaction which cannot be substituted by zoom calls. So, whilst there is acceptance that the road to recovery will be difficult, there is an underlying level of optimism that the industry will recover. As consumers we will get used to new cleaning protocols and be willing to pay more for the services that were once hidden. The most positive outcome is that we will respect and value those people that keep our environments clean and safe more than ever before.